doordash driver taxes reddit

58 cents per mile. Federal income and self-employment taxes are annual.

How Much Money Have You Made Using Doordash Quora

Since DoorDash earnings are treated essentially the same.

. However you may now be wondering what the process is for filing DoorDash taxes in 2022 to ensure you cover any tax liability. If you answer yes it will prompt you for the details. And yes its a big tax write-off.

Posted by 11 months ago. Ive been using everlance. There isnt a quarterly tax for 1099 Doordash couriers.

TurboTax will handle this. Add up all your Doordash Grubhub Uber Eats Instacart and other gig. The forms are filed with the US.

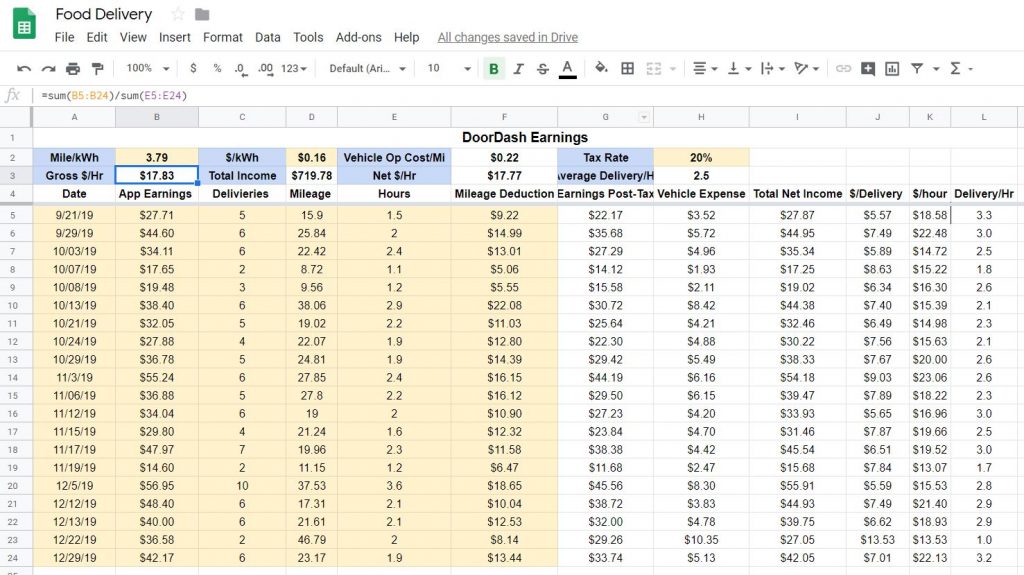

Thats what I use as a fast easy estimate of my taxable income. A 1099-NEC form summarizes Dashers earnings as independent. For W-2 jobs you generally pay taxes in the state.

Log In Sign Up. Because this is a necessity for your job you can deduct the cost of buying the bag at tax time. Internal Revenue Service IRS and if required state tax departments.

We file those on or before April 15 or later if the government. It will ask you if you earned money in another state. What are the quarterly taxes for grubhub doordash uber eats delivery drivers.

I dashed full-time for most of last year and I only paid 400 in taxes after the write-offs. This calculator will have you do this. Part-time DoorDash drivers who also hold a full-time job may find it easier to have a CPA file their taxes since theyll handle a W-2 a 1099-NEC and deductions from their part.

Are taxes really 30 percent of. DoorDash requires all of their drivers to carry an insulated food bag. Be aware the due dates arent exactly quarterly.

If you made more. Up to 8 cash back As a delivery.

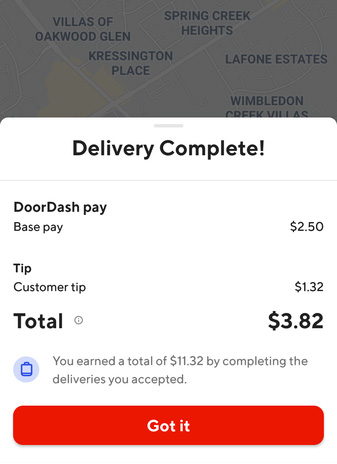

Doordash Drivers Make An Average Of 1 45 An Hour Analysis Finds Salon Com

Doordash Taxes Does Doordash Take Out Taxes How They Work

The Best Gifts For Delivery Drivers According To Delivery Drivers

How Much Can You Make A Week With Doordash 2022 Real Earnings

Are Shop And Deliver Orders On Doordash Worth It For Dashers Ridesharing Driver

My Routine I Hope This Helps New Drivers Estimate Pay And Time Estimated Earnings Taxes Multiapping R Doordash

Is Doordash Worth It In October 2022 Pay Per Hour Month

How To Become A Doordash Driver Doordash Driver Requirements Hyrecar

Doordash Tax Calculator 2022 What Will I Owe How Bad Will It Hurt

Doordash Tax Calculator 2022 What Will I Owe How Bad Will It Hurt

See How Much Doordash Drivers Make Pay Ranging From 1900 Week To 3 Orders Ridesharing Driver

Tips For Filing Doordash Taxes Silver Tax Group

Colorado Shoppers Will Now Pay Retail Delivery Fees On Orders From Amazon Doordash And Others Here S How It Works

It S Gonna Be A No From Me Dawg R Doordash

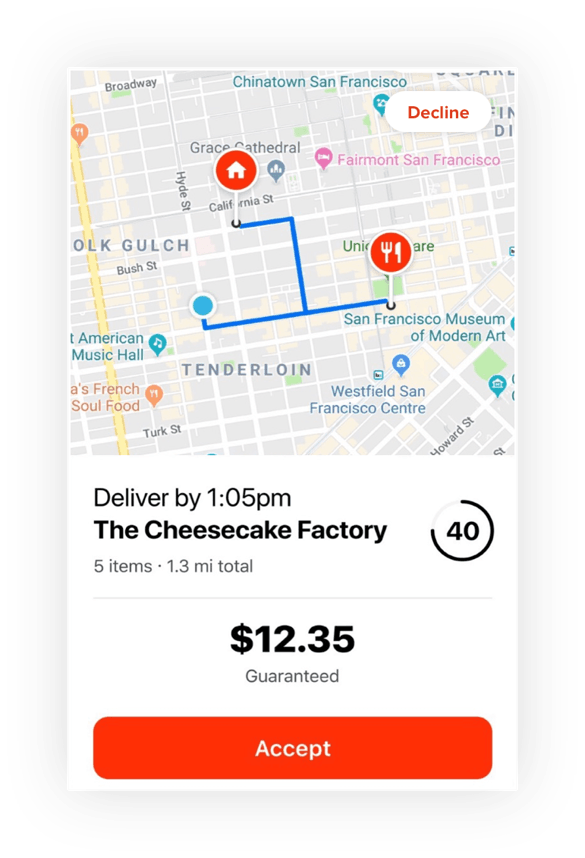

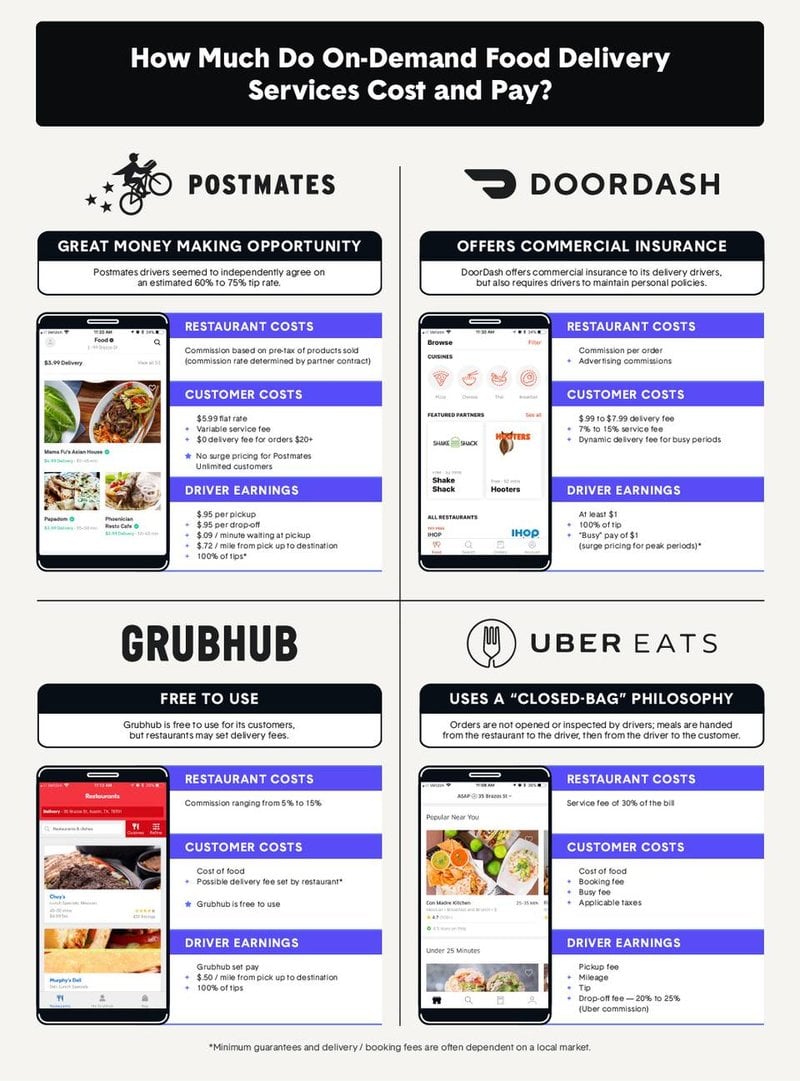

Postmates Doordash Ubereats And Grubhub A Comprehensive Comparison

See How Much Doordash Drivers Make Pay Ranging From 1900 Week To 3 Orders Ridesharing Driver

Doordash With An Electric Vehicle Charged Future